The Chancellor recently announced the government support package for the self-employed.

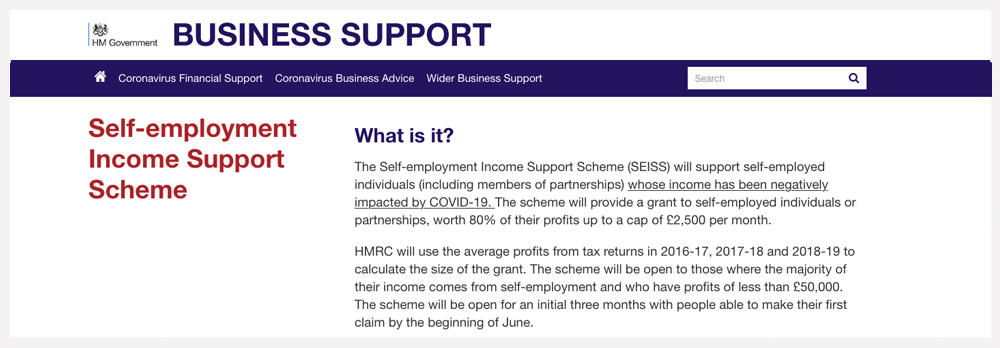

1. Self-employed people will be able to apply for a taxable grant worth 80% of their average profits, up to a maximum of £2,500 a month.

2. The HMRC will use the average taxable profits from tax returns in 2016/17, 2017/18 and 2018/19 to calculate the size of the grant.

3. The grant will be taxed.

4. You can continue to trade if you are able to do so.

5. The grant is available to those with trading profits up to £50,000.

6. Payments will be made by June and backdated to 1st March.

7. You do not need to contact HMRC as they will be in touch with you. They will use existing information to check potential eligibility and invite you to apply once the scheme is operational.

These measures could protect some of the most vulnerable self-employed in the UK. Please note that the grant will be taxed as if it is income, so it is not entirely free money from the Chancellor.

The Forum welcomes this announcement, however, our concerns are that whilst the package helps some of the self-employed community, it only looks at sole traders, not directors of limited companies.

There are nearly 4 million sole traders in the UK, over 2 million limited companies and nearly 900,000 of these are likely to be owner-operator managed businesses.

We feel that the announcement still leaves the bulk of owner / managed limited companies exempt from any ‘real’ government help.

If you are a director of a limited company, you are not self-employed, you are an employee of the company. Therefore HMRC would say you are able to use the Coronavirus Job retention scheme, so furloughing in effect, but we do not believe this would be possible.

This is because the job retention scheme relies upon the employee going into a state of furlough, which is a leave of absence from employment. If you are a director of a limited company it is not possible for you to prove this to HMRC and the Treasury.

The reason it is difficult for you to prove is that the following activities below would be in breach of any leave of absence:

Necessary administration, e.g. contacting your accountant, chasing invoices, running payroll for employees or even buying stationery! Emailing an existing client or searching for new business opportunities. Updating your portfolio or updating your website. Posting on your social media channels, the list goes on.

It seems this group of owner/directors have not been considered for this package.

We will continue to raise our concerns with the government and the media and speak on behalf of you, our members.